Click here to download our Fall 2024 HVAC M&A Sector Update PDF

Still Looking for the Long-Anticipated Recovery

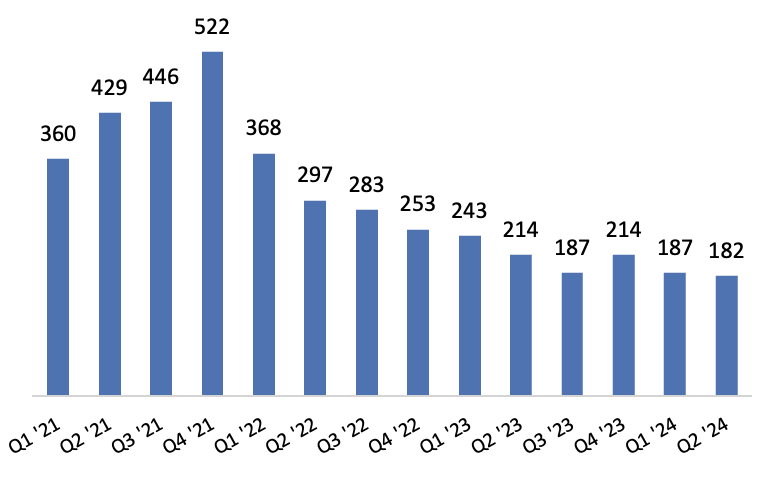

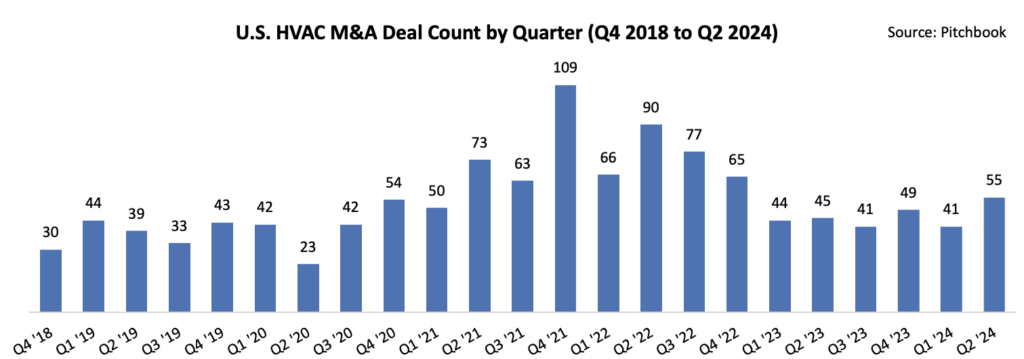

The expected rebound in US middle market M&A in 2024 has been slower than many observers, including ourselves, anticipated. Even as financial conditions have generally improved, previous inflation and monetary policy concerns matched with current regulatory and geopolitical headwinds have tamped down recent M&A activity, when viewed through the lens of closed transaction volumes in US mid-market M&A.

The recent twists and turns in the upcoming US election have introduced new dynamics to the mix, with a renewed focus on potential tax reform as VP Kamala Harris ascends the top of the Democratic Party’s ticket. This shift has sparked questions from business owners about whether to ‘sell now’ to avoid a potential increase to capital gains taxes.

As we continuously advise our current and prospective clients, it is crucial for business owners to focus on long-term value enhancing strategies rather than reacting to external market or policy “what if’s”.

We remain steadfast in this advice despite the fluid state of current events. Politics aside, over the next 12 months, we do expect to see deal activity gradually increase from ‘trough’ levels, driven not by the specter of increased taxes, but rather by fundamentals further pointing to an improving environment for US middle market M&A.

Current deal activity has remained relatively steady over the past four quarters, though LTM deal volumes are down around 20% from the same time last year. Many buyers continue to be cautious, and both strategic and PE investors are being more selective in the sale processes in which they choose to participate, highlighting the need for proper preparation for business owners well ahead of conducting an M&A sale process.

HVAC M&A Market

When looking at M&A in HVAC, we typically break things down by segment, as each industry group has its own unique dynamics, drivers and buyers:

- Manufacturing: Valuations for HVAC manufacturing and equipment companies continue to hold steady. Interest continues to focus on businesses leveraging trends such as increased energy efficiency, green technology, and indoor air quality. Companies that can demonstrate sustainable growth and differentiated technology will remain highly attractive. Strategic buyers may outbid private equity firms in this space, driven by the demand for innovation and growth, with corporates’ cash-rich balance sheets giving them a competitive edge. However, feedback from the market suggests that lending conditions – especially for private equity-backed deals – are improving, giving PE investors the capital, and confidence to compete.

- Distribution: After several challenging years of margin volatility and inventory issues, distribution companies’ financials are stabilizing back to pre-pandemic levels, offering buyers and investors a clearer view for valuations. From our own channel checks while attending the recent HARDI July conference, distributors are still navigating a challenging business and economic backdrop. However, this vital link in the chain between manufacturers and service providers keeps buyer interest at sustainably high levels. Larger players, including OEMs and private equity-backed companies, are expected to continue competing for market share and scalability, driving valuations upward, for large and small company acquisition targets alike.

- Services: Service businesses remain highly attractive to PE investors. The interest in commercial HVAC services opportunities continues, where there are still plenty of platform and add-on acquisition targets available to a captive investor base. Commercial service businesses with a high recurring-revenue component, strong visibility in more stable sectors like education, healthcare, and digital infrastructure, and breadth across geographies and service offerings, will benefit from an environment of rising multiples. While we don’t recommend timing the market, commercial service companies do seem to be a preferred industry of focus currently as the overall M&A market picks up.

On the residential side, while the market is still in mid-innings (we’d term late innings as when more platforms IPO and go public), the general sentiment is that the market has been ‘picked over,’ with few independent platforms of scale left.

We expect existing residential HVAC platforms to continue acquiring smaller firms to capture scale efficiencies, though less opportunities for mid-size middle market companies means that, while the market is still receptive, there is less fervor around residential (vs. commercial) service businesses right now.

Preparation is Key…

Regardless of business segment, in today’s fast-paced M&A landscape, preparation is key to success. We strongly advise assembling a team of trusted advisors, your ‘Core Four,’ to guide you through the process. Remember, “failing to plan is planning to fail.” As always, the CMG team is here to help. Feel free to reach out with any questions or feedback.

Executive Insights: Perspectives from the C-Suite

Carter Morse & Goodrich recently interviewed Jeff Underwood, the President of RectorSeal. Jeff, who formerly led the company’s sales and marketing efforts, was instrumental in fostering both organic and inorganic expansion within the contractor solutions division. Founded in 1968, RectorSeal produces specialty chemical sealants for the HVAC, plumbing, electrical, and construction sectors. The company became a part of CSW Industrials, Inc. in 2015.

Jeff, appreciate you taking the time to speak with us, and congratulations on your recent promotion to President of RectorSeal. As President, what will be your main focus, what excites you, and what challenges are keeping you up at night?

As the new President of RectorSeal, I’m stepping into a role with a lot of momentum. The company has already been a high performing organization, growing rapidly both organically and through acquisitions, which is a fantastic position to inherit. I’m fortunate to be a part of a team where things are already in great shape and to work with many longtime friends.

My main focus is on preparing RectorSeal not just for the immediate future, but for sustained success over the coming years. We’re not just looking at where we are now but where we want to be several years down the line. This involves keeping an eye on industry trends, ensuring we’re staying ahead of the curve, and continuing to build on our strong foundation.

In terms of the broader HVAC industry, what developments are exciting you, and what challenges do you foresee impacting the industry over the longer-term?

The HVAC industry is evolving rapidly, and there’s a lot to be excited about. I’m particularly enthusiastic about the advancements in technology that are improving the performance and longevity of HVAC equipment across the board.

However, the industry is also facing its own challenges. One of my biggest concerns is the ongoing structural labor shortage. As the baby boomers retire, we see a gap in skilled technicians – plumbers, HVAC professionals, and electricians. We need to find ways to appeal to younger people so that they can have strong career opportunities in the trades.

How is the year going so far for RectorSeal? What’s your outlook for the rest of this year and into 2025?

So far, the year has been a mix of challenges and opportunities. In general, the industry, especially on the parts and supplies side, faces headwinds. The usual drivers of demand seem constrained, like fewer existing home sales and the usual repair/replace balance, with consumers currently more inclined to repair rather than replace. Only a hotter-than-normal summer is providing a tailwind.

Regardless of these hurdles, our strategy is to build a go-to- market approach that can thrive even in a challenging environment. Our expectation is to outgrow the market regardless of these conditions.

Regarding M&A, how is your pipeline looking? Can you share any specific M&A initiatives you’re pursuing, and what are your thoughts on the current market for sellers?

Our M&A pipeline is quite active. We’re focusing on expanding our product offerings into faster-growing sub-segments of the market. One example: surge protection and voltage monitoring are becoming increasingly important where the move to multi- speed motors and variable speed compressors increases the need to protect the units’ electronics. We have continued to commercialize a differentiated product offering, gaining share and increasing adoption of the technology.

Within the M&A landscape, our focus continues to be around building strong relationships with entrepreneurs that have been successful but need RectorSeal to help get their offering to the next level.

With that being said, what advice do you have for family and founder-led companies considering an M&A transaction on how to proceed and prepare?

Before you start the sale process, be clear about what’s important to you and your family. Understand your priorities regarding your company’s legacy, your executive team, your employees and the overall transaction proceeds. Different owners’ priorities are as unique and nuanced as the companies themselves. Having this clarity will help you navigate the sale process with less stress and more focus, ensuring you make decisions that align with your long-term goals and values.

If you are considering a sale in the near future, it’s crucial to focus on strengthening your business before the process begins. We look for companies that are performing well, not ones that need fixing. Anything that an owner can do to strengthen their underlying business will generally result in a faster sales process and a better valuation. Maximizing a sale outcome and running a great company generally require the same steps in advance. The key word is preparation. That is why you should hire an advisor like CMG that knows the dynamics of family businesses and can help you navigate the potential pitfalls, and value drivers, which make or break an M&A sale process.

Contact Us

Whether you are actively considering an exit or just curious about options for the future, we would love to connect, learn more and truly understand your objectives. We are happy to share our insights and help explore strategies to maximize the value of your company and enhance the legacy of your business.

Ramsey Goodrich

203-349-8375 (Direct)

203-554-2435 (Mobile)

RGoodrich@CarterMorse.com

Christopher Reenock

203-349-8376 (Direct)

917-334-1739 (Mobile)

CReenock@CarterMorse.com

Geoff Bradley

203-312-4587 (Mobile)

gbradley@CarterMorse.com